Nune Chanunpat

Ngernturbo

Thai Auto Insurance Research

Ngernturbo, a non-bank financial services company in Thailand, specializes in vehicle registration loans. Recently, the company has been preparing to expand fully into the auto insurance sector to offer more convenience to its customers.

This project focused on identifying key challenges and providing practical insights to guide management in making strategic decisions. To ensure accuracy and relevance for the target audience, all research—including surveys and interviews—was conducted in Thai.

Discovery

From Numbers to Narratives

At the outset, the business focus was clear: numbers. The company had a goal to scale its insurance offerings, and the initial objectives were primarily profit-driven. However, while the targets were ambitious, they lacked actionable details on how to achieve them.

At the core of this project was a shift in focus—from profit-driven objectives to understanding real customer behaviors. Instead of just asking how to sell more policies, we sought to uncover why and how customers engage with auto insurance in the first place.

To answer this, we took a triangulated research approach, combining internal data analysis, competitive research, surveys, and user interviews. This allowed us to validate existing assumptions, uncover new insights, and build a more customer-centric strateg

Key Research Questions & Methods

01

Who are our current customers, and what patterns exist in their buying behavior?

Internal data analysis & industry reports

02

How do competitors sell insurance, and what differentiates them in the market?

Competitive research

03

What factors influence customer decisions and trust?

Surveys

04

Why do offline channels still dominate despite digital alternatives?

User interviews

By structuring our research in this way, we ensured that each method complemented the others, creating a holistic view of the market landscape.

Research

Decoding the industry

Our research began with a deep dive into internal data to understand who our current auto insurance customers were. We looked at policy sales, customer demographics, and purchasing behaviors—seeking patterns that could reveal hidden opportunities.

While these numbers told us who was buying, they didn’t tell us why or how.

To gain a broader perspective, we explored external industry reports from the Office of Insurance Commission, IBM Institute for Business Value, and CAPCO. These sources provided valuable insights into global and local market trends, shedding light on emerging technologies, evolving customer expectations, and the challenges insurers face both in Thailand and worldwide.

Key Findings

📌 Face-to-face remains king

According to Q1 2024 data from the Office of Insurance Commission, the majority of policies were still sold through in-person channels, signaling that digital adoption remains an untapped opportunity.

📉 The industry is stuck in the past

Despite the rise of digital services in other sectors, auto insurance in Thailand still relies on human networks and outdated legacy systems, making customer acquisition slow and inefficient.

🔍 Customers want more, but choices are limited

Policyholders crave personalized insurance options, but most offerings remain rigid and static, failing to adapt to individual needs

🚀 A market ripe for innovation

The biggest opportunity lies in expanding beyond traditional coverage and embracing an omnichannel approach—integrating both online and offline experiences to provide seamless and flexible insurance solutions.

By leveraging data, industry insights, and competitor analysis, we built a strong foundation for the next phase of research—directly engaging with real customers to uncover their motivations, pain points, and expectations.

Research

Uncovering How Customers Buy Auto Insurance

To gain deeper insights into customer behavior, we conducted a survey and user interviews, targeting individuals who actively purchase auto insurance. Our approach was designed to filter out responses that did not align with our research objectives, ensuring high-quality data.

Participants Criteria

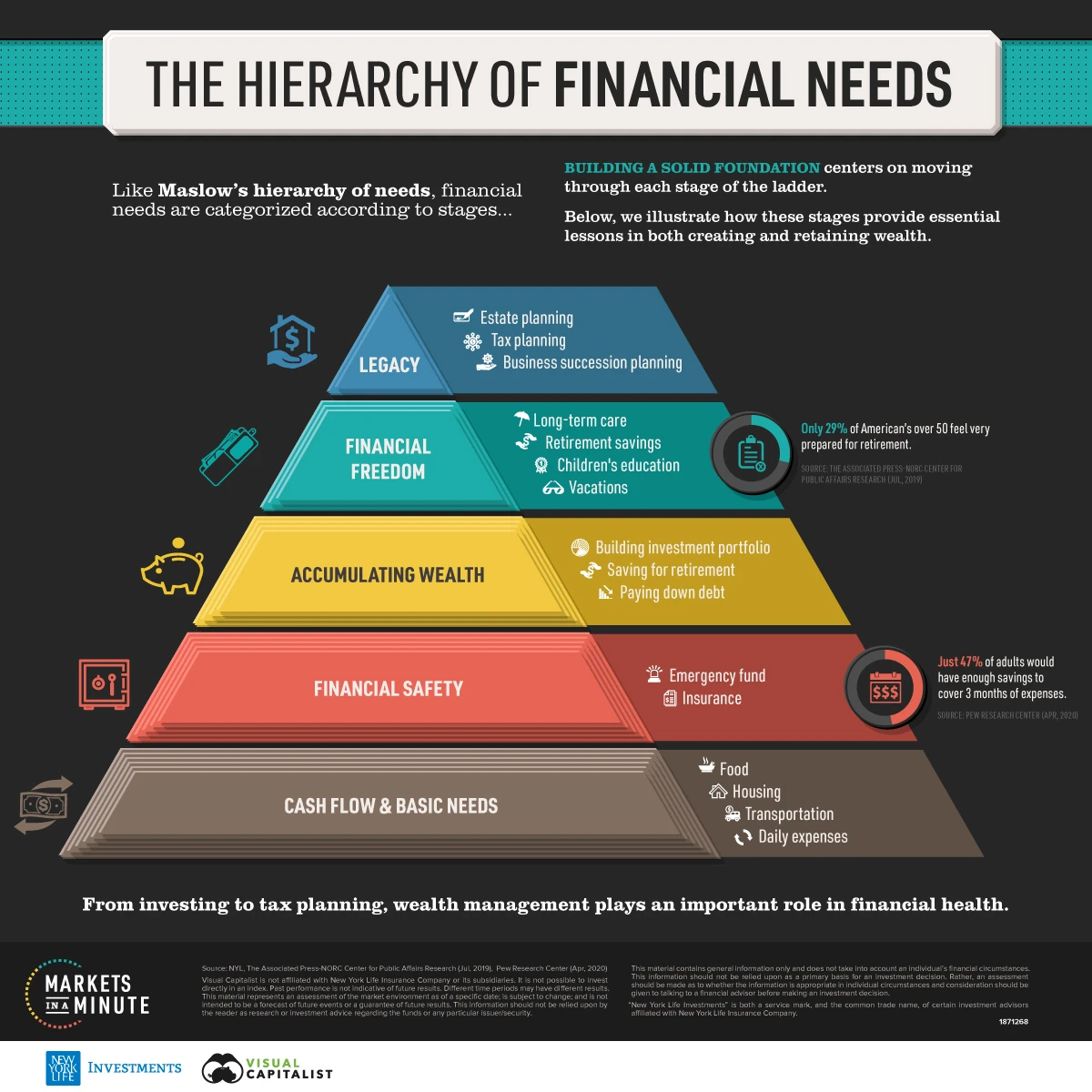

If individuals earn above their living expense, they're more likely to purchase insurance

Insurance is often viewed as a discretionary expense. Using Maslow’s hierarchy of financial needs, we estimated the minimum monthly income (at least 30,000 baht) needed to afford voluntary auto insurance based on living costs in major cities like Bangkok.

01

Working Age Customer

We focused on individuals aged 18-59, as they are legally able to drive and purchase auto insurance.

02

Self-Purchasing Customers

We aimed to understand customers who purchase insurance on their own, distinct from those families handle the purchase—a crucial distinction, as the line between these methods often blurs with conventional approaches.

03

Multi-Provider Switchers

Rather than relying on years of driving experience, we targeted customers who frequently switch providers, as their habits reveal deeper insights into decision-making and satisfaction.

04

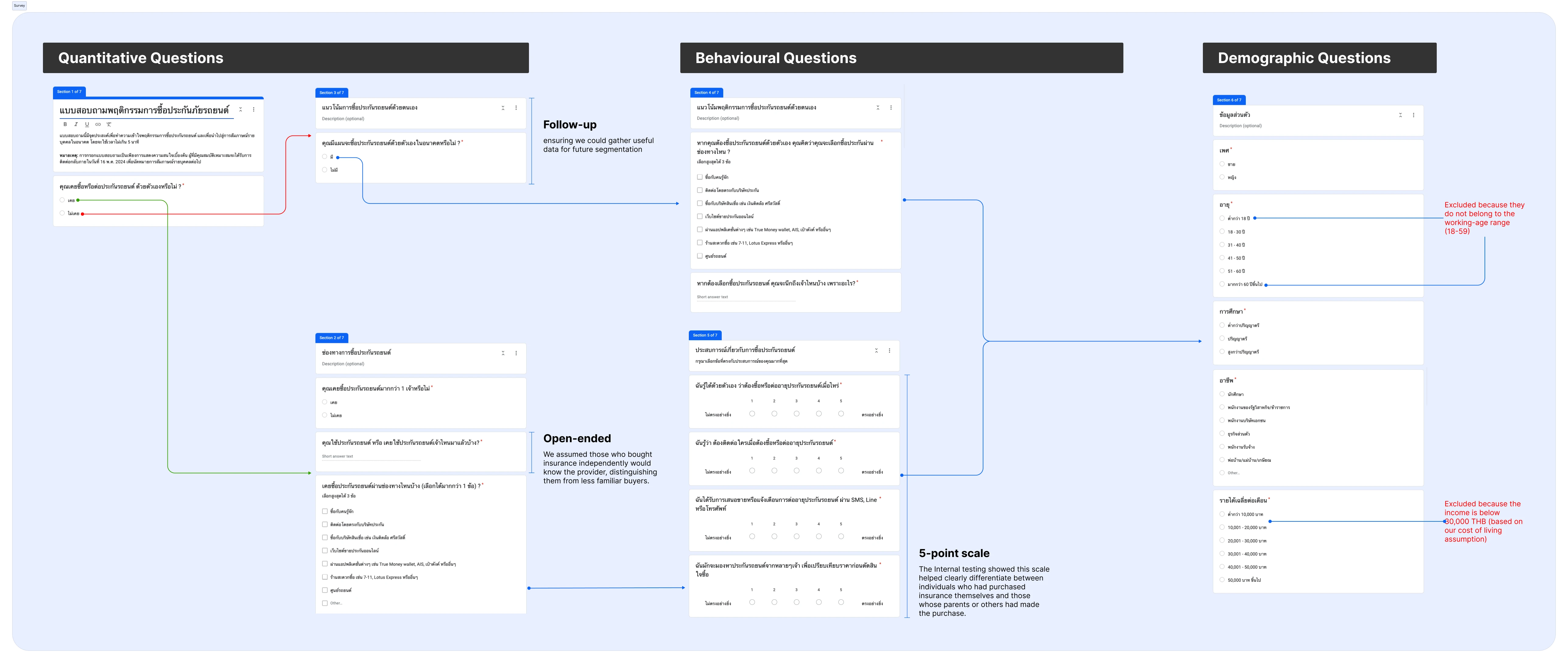

Structuring the Survey

Once participants were defined, we structured the survey into three sections:

Quantitative Questions – To gather objective data based on our criteria.

Behavioral Questions – These were designed to gain deeper insights into user behavior using scenario-based questions.

Demographic Questions – These not only collected demographic data but also screened participants to ensure they genuinely fit our topic, rather than being incentive-driven.

Survey Questions and Flow

Survey: What We Learned from 101 Customers

We surveyed 101 participants, focusing on individuals who actively purchase insurance, are financially independent, and are within the working-age range (18-59). Our findings showed:

📌 71% knew when to buy or renew their insurance.

📌 58% were aware of their renewal timing.

📌 57% compared different insurers before purchasing.

At first, it seemed like most customers managed their insurance decisions independently. But data alone doesn’t tell the full story—so we conducted interviews to dig deeper.

What the Interviews Revealed

We conducted in-depth interviews with 9 participants selected from the survey on June 1-2, 2024, uncovering key insights that numbers alone wouldn’t reveal.

🔹 People don’t actually remember their renewal dates. While most respondents said they "knew" when to renew, none could recall the exact date. Instead, they relied on reminder calls from insurers to prompt them to take action.

🔹 Customers like comparing options—but not too many. The survey showed a strong preference for shopping around, but interviews revealed that too many choices feel overwhelming. Most users prefer 3-4 tailored options rather than browsing through endless lists.

🔹 Confidence is key to decision-making. Many customers already have a preferred insurer or specific criteria in mind. A well-structured comparison feature helps reassure them that they’re making the best choice.

Ideation

Proposing Storyboard

By leveraging data, industry insights, and competitor analysis, we built a strong foundation for the next phase of research—directly engaging with real customers to uncover their motivations, pain points, and expectations.

Conclusion

Impact and Takeaways

Redesigning the QA document review process wasn’t just about improving usability—it was about creating a structured, efficient, and scalable system that truly supports its users. With these major redesigns, we transformed a manual, time-consuming workflow into a more intuitive and error-resistant process.

Impacts

Our research provided a comprehensive understanding of user behaviors and addressed the questions we had set out to explore. The key insights, detailed below, were aligned with our current resources and capabilities, enabling us to implement immediate improvements while also clarifying the product's long-term vision. Following this, we presented our findings and proposed solutions to the CEO, whose positive feedback initiated further discussions and a follow-up session. This session catalyzed collaboration with on-ground staff and cross-departmental brainstorming that led to the development of practical and impactful solutions.

Personal Takeaways

I observed that the insurance industry has seen little innovation over the past decades, the process, coverage options, and manual workflows contributing to low customer satisfaction. Traditional sales methods, such as cold calls, do not resonate with today’s preference for quick, digital interactions.

Before conducting this research, we were quite concerned about not gaining trust or having our findings doubted. However, having a well-thought-out plan with clear reasoning and evidence helped establish credibility. This approach not only earned trust but also helped the team recognize research as a critical decision-making tool, especially in uncertain situations, demonstrating its effectiveness in guiding the team forward.

During the research, I found it crucial to plan for adequate break sessions (30 minutes to 1 hour might not be enough) due to factors like participants arriving late or interview sessions running longer than expected, which can impact subsequent appointments.